Webcast and presentation

Download the podcast (MP3 34 MB)

Download the presentation (PDF 5.5 MB)

Transcript

View the 2024 Q2 results presentation and read the transcript slide by slide.

Download the podcast (MP3 34 MB)

Download the presentation (PDF 5.5 MB)

View the 2024 Q2 results presentation and read the transcript slide by slide.

Good morning and good afternoon, everyone. Thank you for joining our Q2 2024 earnings call.

The information presented today contains forward-looking statements that involve known and unknown risks, uncertainties and other factors. These may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. For a description of some of these factors, please refer to the company's Form 20-F and its most recent quarterly results on Form 6-K that respectively were filed with and furnished to the US Securities and Exchange Commission. (Event instructions) And with that, I will hand across to Vas.

Thank you, Sloan, and thank you, everyone, for joining today's conference call. With me on the call as always is our CFO, Harry Kirsch.

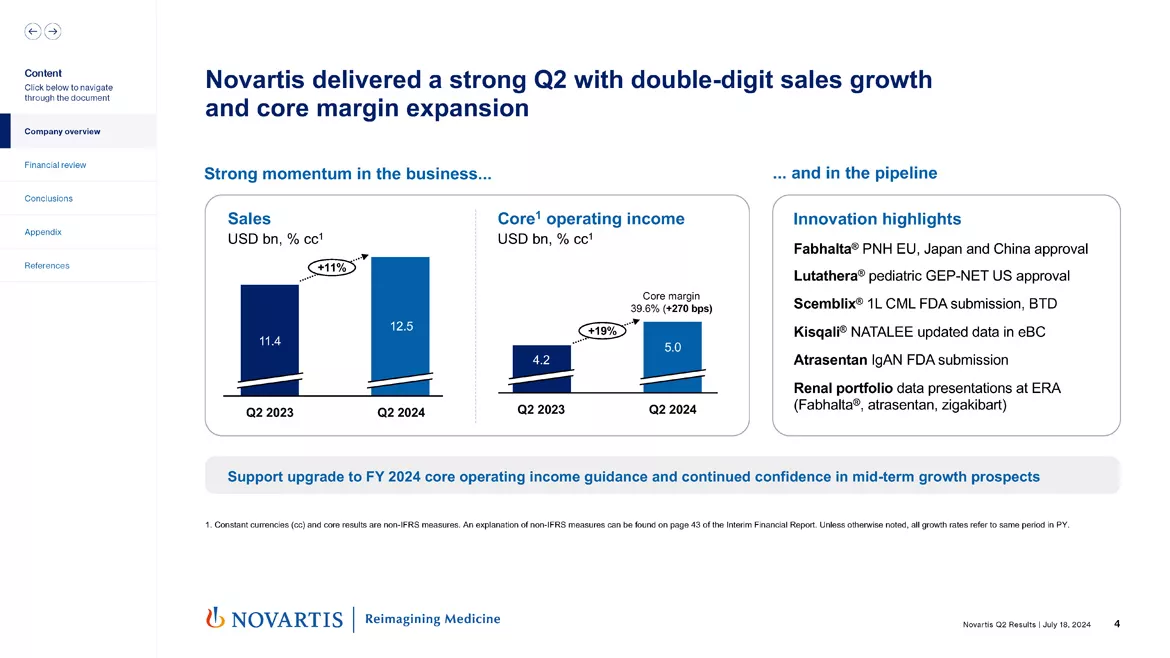

So starting with Slide 4. As you saw in quarter two, we continued the strong growth performance at Novartis, which gives us conviction that we are well on track to deliver our 5% plus sales growth out to 2028 and a 40% margin target in 2027. You saw that sales in the quarter were up 11% in constant currency, core operating income up 19%. Our core margin reached 39.6%, reflecting our outstanding productivity programs, but also as a consequence of our strong sales growth.

In addition, we had important innovation highlights in the quarter, which we'll review over the course of the call. But some of the really important ones included Scemblix® first-line CML FDA submission, updated Kisqali® NATALEE data, which we think really supports the outstanding profile of Kisqali® in the adjuvant setting, in the early breast cancer setting, and we're looking forward to presenting that outstanding data at an upcoming medical congress. And continuing to build out our renal portfolio with the atrasentan submission, as well as our broader portfolio of presentations at the recent ERA meetings.

Taken together, this allowed us to upgrade our full year 2024 core operating income guidance. Harry will go through that in more detail.

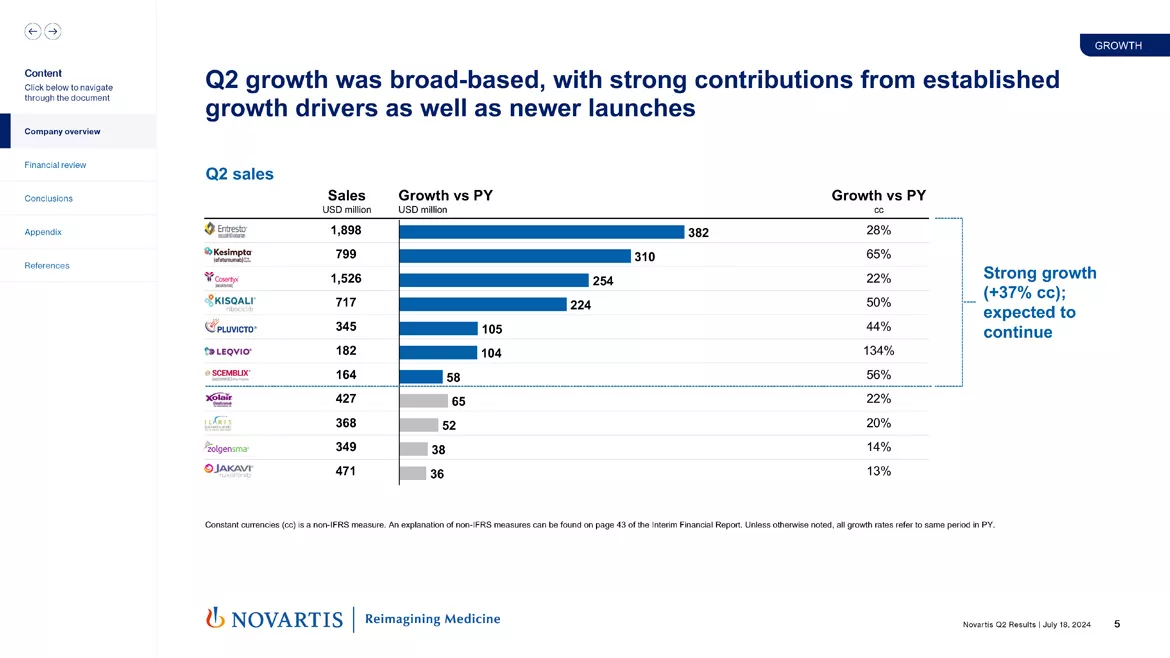

Now moving to slide 5. Our Q2 growth was broad-based, and we had strong contributions from multiple of our outstanding growth drivers. Importantly, Kesimpta® was also a really outstanding start earlier in the year and continued that momentum. Kisqali® also continued its strong momentum. Cosentyx® with the recent launches, continues to grow in a robust way. We saw steady growth in Pluvicto®, strong growth in Leqvio® and Scemblix®. And taken together a 37% constant currency growth, which we expect to continue.

Taking each one of these brands in turn, step by step. Entresto® delivered 28% growth in quarter two, and we continue to have high confidence we will exceed our USD 7 billion peak sales guidance for this medicine. That growth was driven by all our core geographies. You can see here in the middle panel, US weekly TRx reached another record high. That 25% growth was fueled by consistent demand across the various segments that we compete in.

Outside of the US, growth was 30%, with strong contribution from China and Japan, where we continue to see momentum from Entresto® in heart failure, but importantly as well, in hypertension. So we remain confident in the continued sustained performance of the medicine.

For forecasting purposes, we continue to assume an Entresto® LOE in mid-2025. However, we continue to enforce our patents and litigate our patents, and will ensure that we maximize this brand for as long as possible in the United States alongside EU RDP in November of 2026.

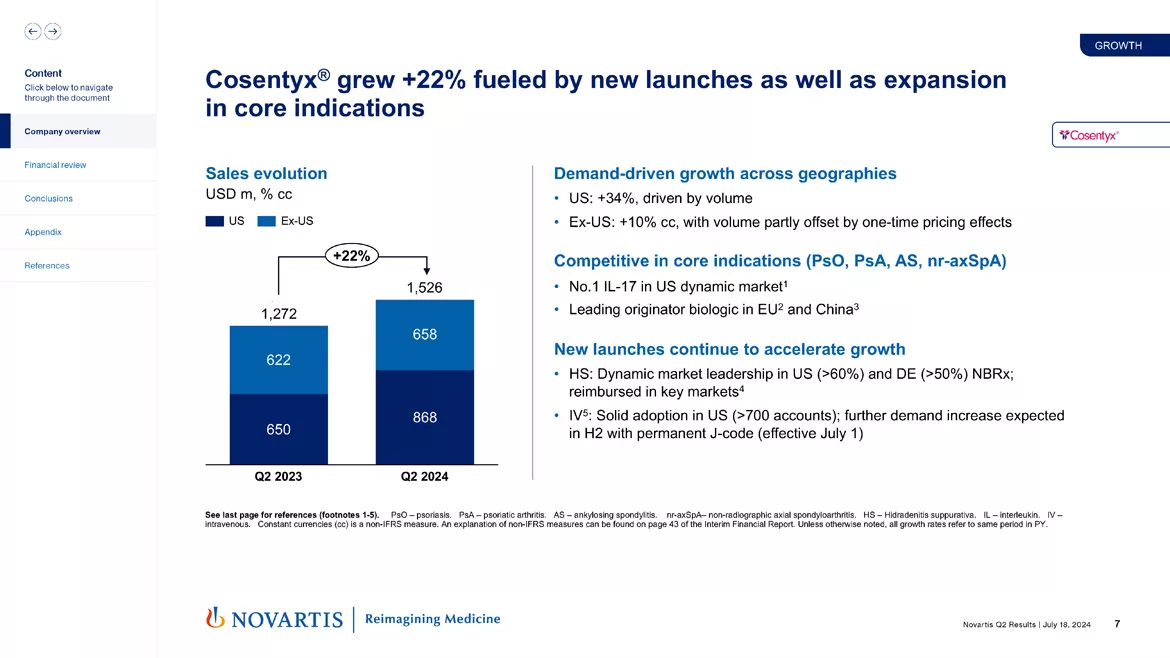

Then moving to slide 7. Cosentyx® grew at 22% in the quarter, and this is fueled by our new launches. And I think importantly, if you take a step back, puts us well on our trajectory to reach USD 7 billion plus of our peak sales for Cosentyx®. When you look at the demand growth by geography, the US grew 34%, driven by volume.

Ex-US, we were up 10%. And this was partially offset by onetime pricing effects due in Germany, in particular, due to the addition of additional new indication. Normal part of the German process as you get additional indications you do see price adjustments. We see Cosentyx® doing very well in its core indications.

I think one important dynamic is the strong launch in HS is supporting us in our core indications of psoriasis, PsA, and AS. We're the number one IL-17 in the US dynamic market, the lead originator biologic in Europe and China.

In HS, we're seeing a very strong uptake with market leadership share of over 60% in the NBRx. In Germany, we're over 50%. And I think importantly, with the launch of Cosentyx®, we're seeing increased diagnosis and desire to treat amongst physicians and patients, which I think will allow the HS market to grow to larger than its historically been. And of course, allow Cosentyx® to help these patients achieve their treatment goals.

For Cosentyx® IV, we saw solid adoption with over 700 accounts now ordering. And we do expect further demand increases in the second half now that we have a permanent J-code in effect as of July 1.

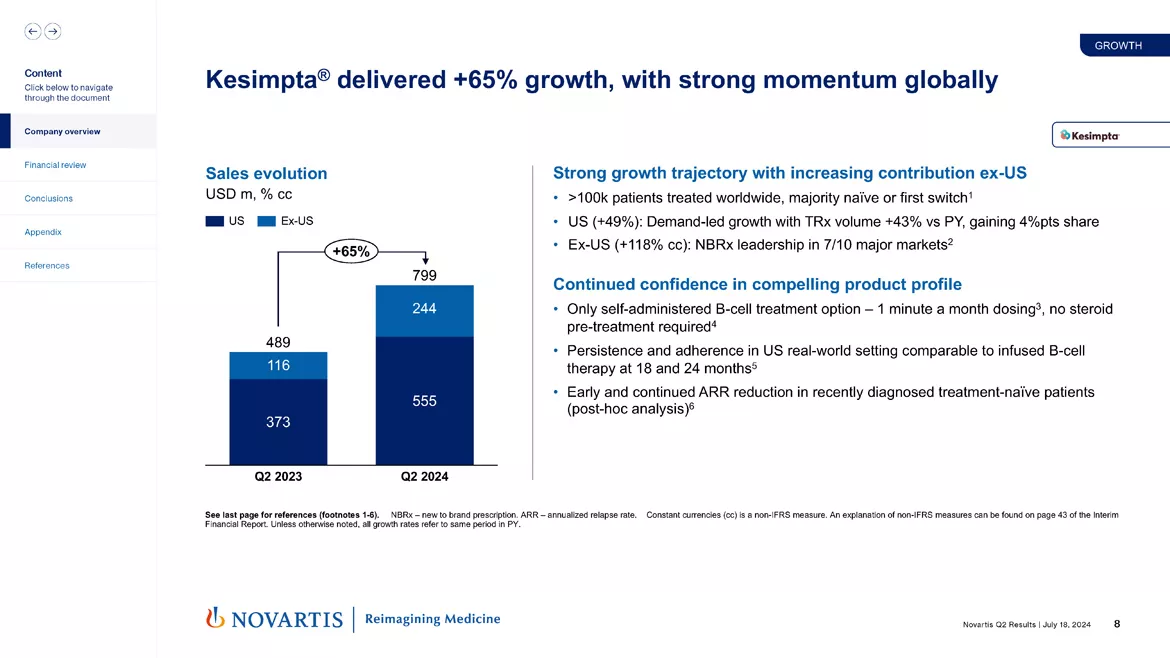

So moving to slide 8. Kesimpta® also delivered, as I mentioned, a very strong quarter too, 65% growth. This was broad-based in terms of geographic growth profile. Over 100,000 patients have now been treated worldwide, naive or first switch with Kesimpta®. In the US, we saw 49% growth. This demand growth was driven by TRx volume of 43% versus prior year. We gained 4% market share overall in the segment. Outside of the US, we have an NBRx leadership in 7 out of 10 major markets.

So looking forward, we feel confident we will exceed our Kesimpta® USD 4 billion guidance, peak sales guidance. We see a strong trajectory for this brand. Its profile is unique. Self-administered B-cell treatment option, one minute a month dosing, no steroid pretreatment required, an attractive safety profile with respect to injection site reactions. Persistence and adherence we're seeing in the real-world setting is comparable to infused B-cell therapies. We also continue to generate data which support the strong efficacy profile of this medicine.

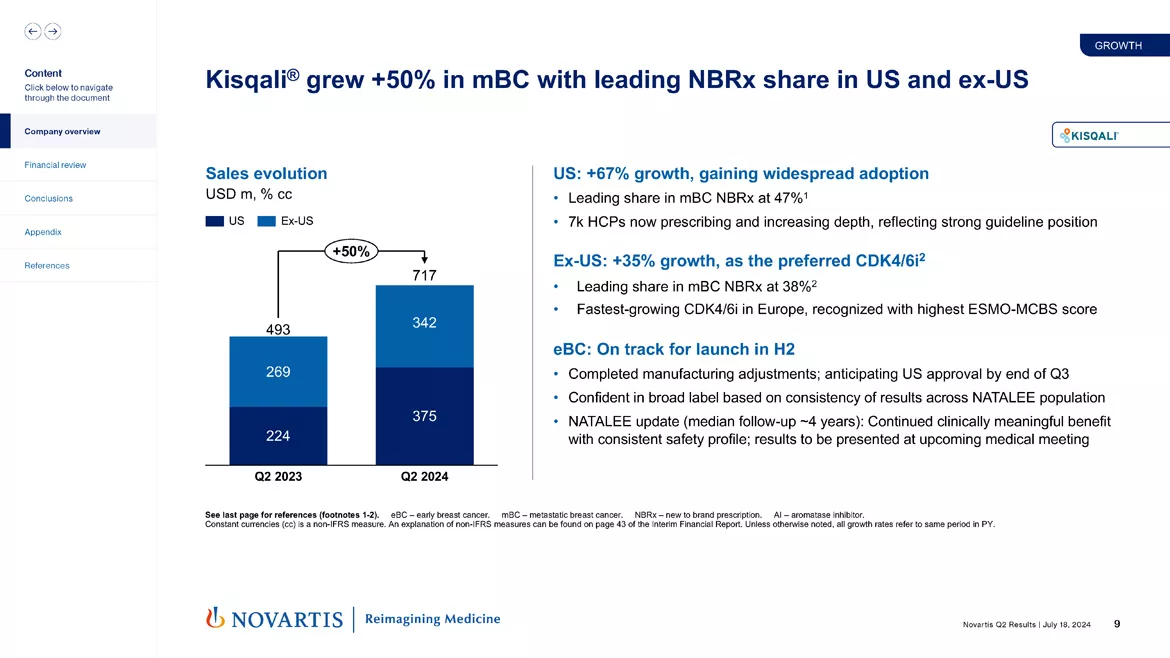

So moving to slide 9. Kisqali® grew 50% in the metastatic setting and with now leading – continued leading NBRx share in the US and ex-US. As you know, Kisqali® has an outstanding data profile in the metastatic breast cancer setting. That's really supporting us consistently now around the world.

In the US, we saw a 67% growth, where we gained widespread adoption. We have a leading share now NBRx share of 47%. 7,000 HCPs now prescribing and that provides us a very strong base of physicians, which we can leverage as we move to the early breast cancer launch. Similarly, outside of the US, 35% growth as the preferred CDK4/6 inhibitor. We have a leading share of 38%. We're the fastest-growing CDK4/6 inhibitor in Europe.

And when you look at the early breast cancer setting, we're on track now for a launch in half two. We've completed the manufacturing adjustments in close collaboration with the FDA, which we outlined earlier in the year. We're now anticipating a US approval by the end of quarter three. We remain confident in a broad label based on the consistency of results that we've seen across the NATALEE population.

And as we announced this morning, we have now updated the NATALEE data with a median follow-up of four years. All patients have now completed their three-year course of the medicine. And we see continued clinically meaningful benefit, consistent safety profile. We believe very compelling results that will really support the launch of this medicine. And so we're really excited to present that data at an upcoming medical meeting and continue to support that Kisqali® will hopefully be the preferred medicine for patients with early breast cancer.

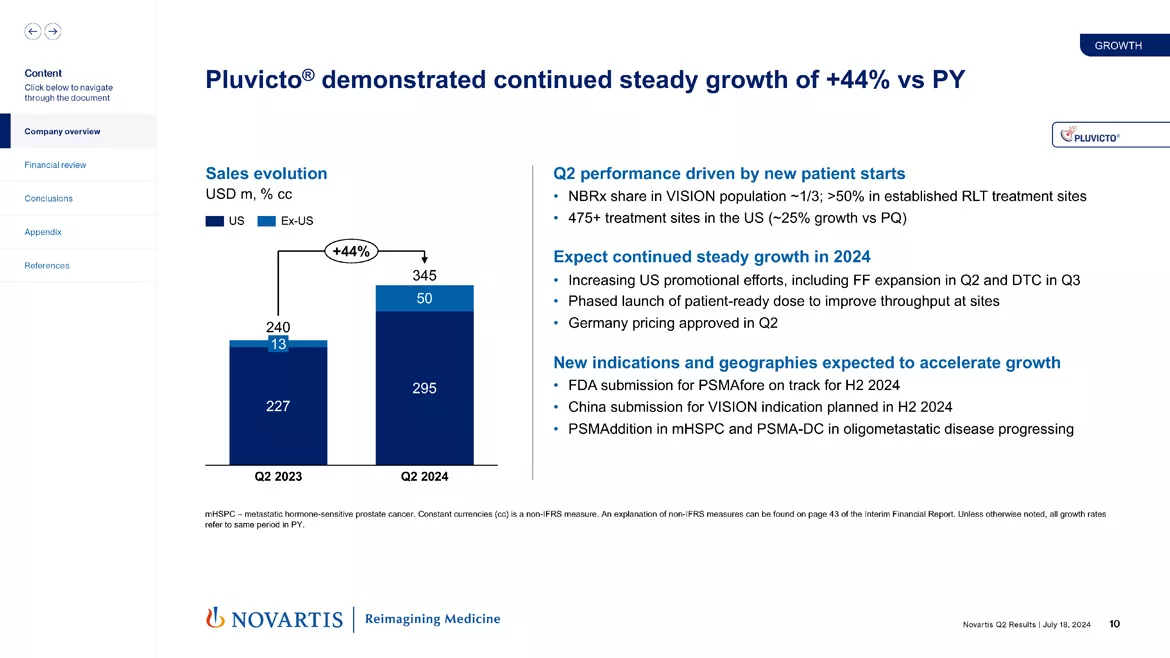

Now moving to slide 10. So Pluvicto® has demonstrated very steady growth versus prior year. Now when you take a step back on Pluvicto®, we're now in a transition point where our early rapid uptake is now transitioning to a place where we need to generate demand in the next wave of centers, and then eventually have the community oncology, both for the success of Pluvicto® but also for the long-term success of RLT.

That said, we remain highly confident in the long-term prospects of Pluvicto® to be a multibillion-dollar medicine across the various segments that we'll compete in. We do believe that once we're through this period, we will get back to robust growth, particularly driven by the PSMAfore indication and later, the HSPC and all of the metastatic indications. We had growth, as I mentioned, of 44% on the quarter.

Now when you look specifically at the VISION population, we estimate our market share is in the mid-30%, with 50% share in established RLT treatment sites. We see a dynamic where the sites where we're well established we could have market shares above 90%. We have another group of sites where we're working to go from 50% to 90%.

And then we have a third – about a third of sites of the 475 treatment sites that we're operating in, where we need to now get from 10% of share of the VISION population, hopefully up over time now to 50%, 90%. And that will drive the steady growth that we expect over the course of the coming quarters.

Now when you look specifically at what we're doing to supercharge Pluvicto® and also enable us to build a broad capacity for the system to take on RLT, we're increasing our US promotional efforts, including a field force expansion, which is now completed. We'll be launching a DTC campaign in quarter three.

We'll also have the phased launch of the patient-ready dose, which is a very important I think step in that it reduces the time from providing Pluvicto® from around an hour to less than 10 minutes. And this will allow sites to hopefully take on more patients, especially sites that have significant capacity to take on more VISION patients.

And then lastly, we had German pricing approved, which is why you've seen the uplift in the ex-US market, ex-US sales profile.

So looking ahead, FDA submission for PSMAfore on track in half two. We already have profiled the positive trend in OS in PSMAfore. China submission is planned in the second half, and we did do a groundbreaking now for a RLT manufacturing site in China, alongside plan also for manufacturing sites in Japan. And then PSMAddition and PSMA-DC continue to progress as per plan.

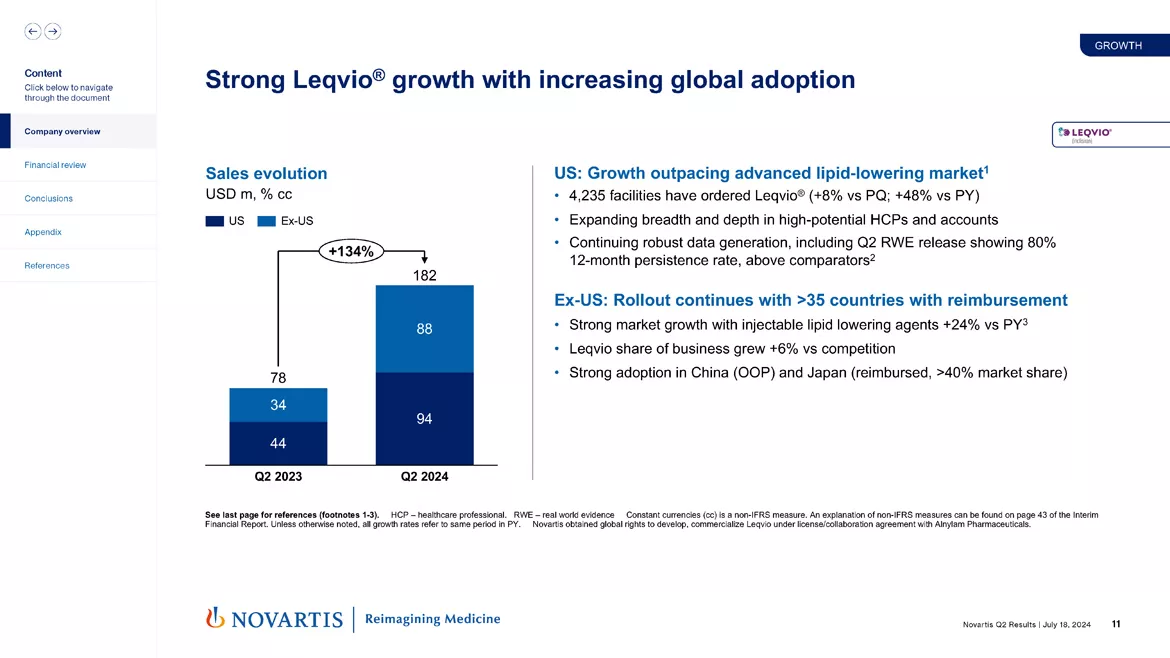

So moving to slide 11. Leqvio® had strong growth as well, 134% growth. I think we're seeing step by step, more and more acceptance of the option to take twice-a-year medicine to achieve 50% to 60% cholesterol lowering. and that's a trend we're seeing broad-based around the world. We have now 4,200 facilities ordering Leqvio® in the US.

We continue to steadily expand our breadth and depth, continue to generate additional data to support the profile of Leqvio® as we move also towards our outcomes trials, two outcomes trials for Leqvio®. As well as continue to progress efforts to move Leqvio® into the frontline setting for cholesterol management.

Outside of the US, our rollout continues with over 35 countries with reimbursement strong. Market growth, 24% versus prior year. And so we feel confident step-by-step Leqvio® will also progressing towards its multibillion-dollar goal.

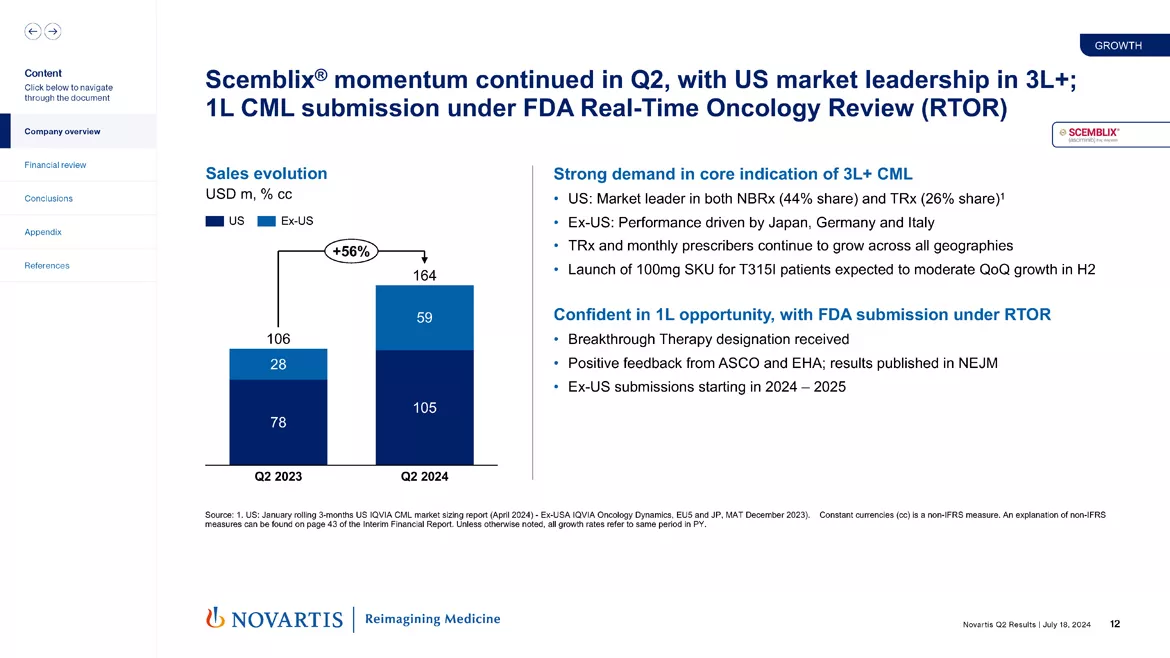

Now moving to slide 12. Scemblix®'s momentum continued in quarter two. And I think as you're all aware, we have US market leadership in the third line setting. And most importantly, at ASCO, we presented our outstanding first-line data, which I'll go in a little bit further detail about on the next slide.

Now when you look at the third-line setting, we're the market leader in NBRx and TRx share in the US. Outstanding performance as well we're seeing outside of the United States. TRx and monthly prescribers continue to grow across all geographies.

One important note for modeling purposes is that in – shortly, we'll be launching a 100-milligram SKU for the T315I patients, a patient group that requires 400 milligrams of Scemblix®, which is about 10 pills per day, they will now be able to take 4 pills per day. But what that will lead to is about a USD 15 million sales that will not repeat in quarter two and quarter three.

So for all your modeling, just to take into account that because of that price adjust, the 100-milligram dose being launched, because we have consistent pricing across SKUs, that adjustment just needs to be factored into your models for Scemblix®.

But more importantly, we're very confident in the first-line opportunity. We have FDA submission under real-time oncology review. We received breakthrough therapy designation. I think all of you saw the truly outstanding data at ASCO that positioned Scemblix® the medicine of choice for patients in the frontline setting. And we're looking forward to also completing our ex-US submissions in 2024 and 2025.

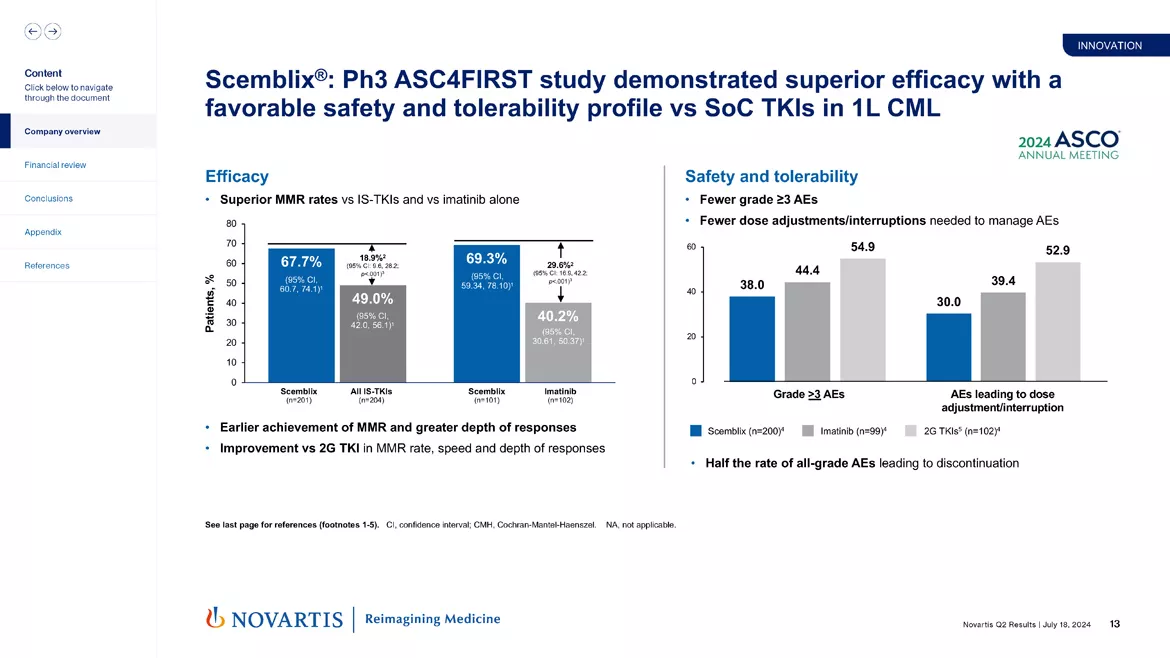

Now moving to the Scemblix® ASCO data. As a reminder, this was data that demonstrated superior efficacy and a favorable safety and tolerability profile against standard of care TKIs in first-line CML. Efficacy-wise, superior MMR rates and also deep molecular response, importantly as well against all TKIs and against imatinib with very impressive differences. We had earlier achievement of MMR, greater depth of responses. Also important improvement versus second-gen TKIs in MMR speed and depth.

And then very importantly, as well for these patients, and I think from a physician standpoint as well, outstanding safety and tolerability. Fewer Grade 3 AEs, fewer dose adjustments or interruptions. Really making Scemblix®, I think, from a safety profile, the medicine of choice for these patients.

So we're very excited about bringing this medicine forward. We guided to USD 3 billion-plus peak sales for Scemblix®. As a reminder, Scemblix® has protection into the mid-2030s. Also is not – because as a rare disease medicine will not be part – expected to be part of the IRA. So a really great profile. Great medicine. Very excited about its future.

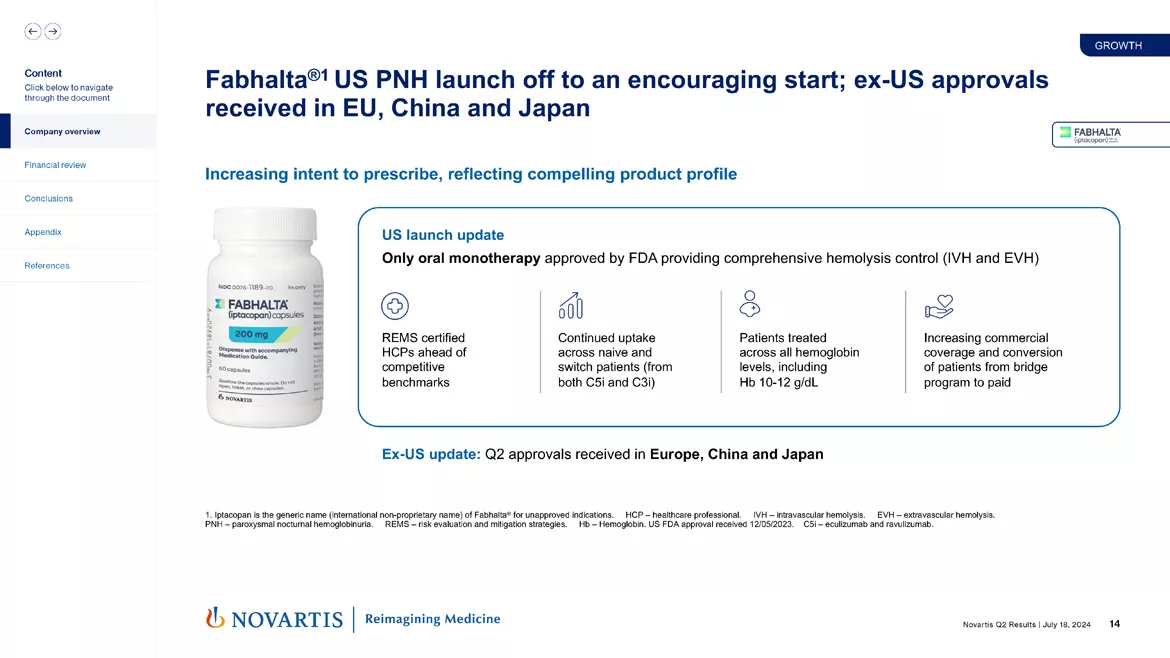

Now turning to Fabhalta®. We had the US PNH launch, which is off to a very encouraging start. We saw really strong growth in quarter two versus quarter one. Ex-US approvals have also been received now in multiple markets.

And when you look at the profile of Fabhalta®, we're making steady progress. We have REMS-certified HCPs ahead of competitive benchmarks. We see continued uptake across naive and switch patients. Patients are getting treated across all hemoglobin levels, but also including those patients at 10 to 12 or just slightly below normal I think, showing the interest there is in a twice-a-day oral option. We also see increasing commercial coverage as part of our – from our bridge program.

So all on track with respect to Fabhalta®. We would expect in the second half to now see steady growth, but also to take into account that the bolus of patients that we saw in the first half, especially the conversion from bridge, likely won't repeat in the second half. So our growth rate will be steady, and I think it's exciting, but also certainly not at the rates that we saw in the early part of the year.

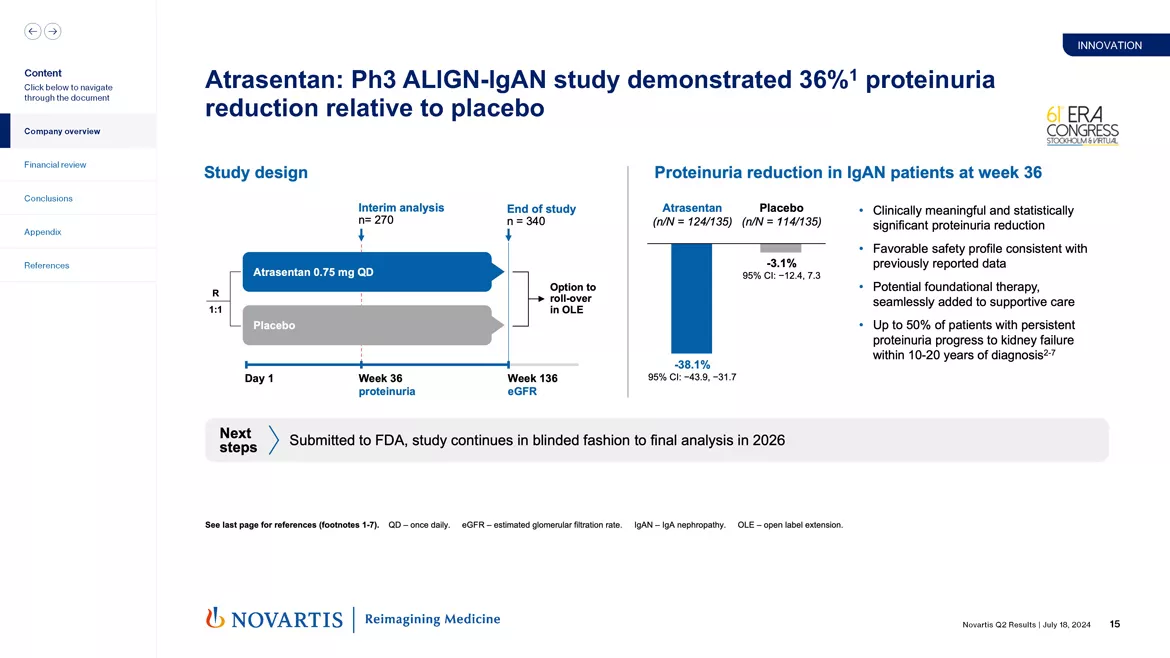

Now moving to slide 15. Turning to our renal portfolio, as you all know, we've been working to build an attractive portfolio to manage IgAN, C3G and related renal diseases. And as part of that effort, we acquired atrasentan. And in the Phase III ALIGN-IgAN study, we announced at ERA in May, a 36% proteinuria reduction relative to placebo. We're very excited about this medicine as we think it can be a foundational medicine to provide hemodynamic and nephroprotective potential for patients and physicians.

It's a clinically meaningful proteinuria reduction. We see a very favorable safety profile. We think up to 50% of patients with persistent proteinuria progress to kidney failure. So important that these patients get better options. We've submitted to FDA. And of course, the study continues in a blinded fashion to 2026 when we would read out the eGFR. So looking forward to launching this medicine in 2025.

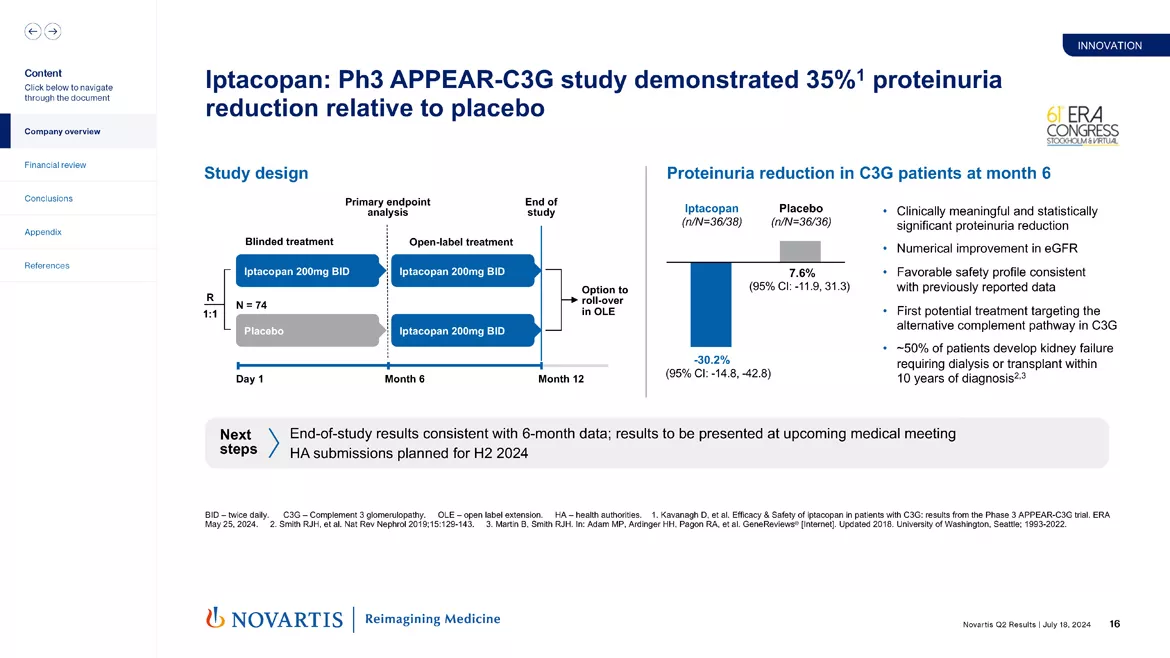

Alongside that, with iptacopan, we also announced at ERA, the full result Phase III APPEAR-C3G study, which demonstrated 35% proteinuria reduction relative to placebo. You can see the design on the left-hand side of the slide. On the right-hand side, you see that impressive minus 30% versus an increase of 7.6% in the placebo arm. We saw numerical improvements in eGFR, favorable safety profile overall. This would be the first treatment – potential treatment targeting the complement pathway in C3G. And again, in these patients, 50% of patients develop kidney failure requiring dialysis.

Now importantly, today, we're also announcing that we have end of study results for this medicine at the 12-month time point. That data is consistent with the six-month data, which now allows us to move forward with the filing in the second half of 2024, with an expected launch next year. We'll present that end-of-study data at an upcoming medical meeting. But I think this is an important update for this medicine, allowing us to now have also, hopefully next year, in three separate indications.

I'd also note, we're also working to develop Fabhalta® in atypical hemolytic uremic syndrome. We announced the start of a Phase III program in myasthenia gravis. So we're very excited, another medicine that has LOE protection well into the 2030s.

And then as well, primarily treating younger patients, not a medicine that's exposed to the Medicare Part D IRA. So another medicine that we have, we think that can really drive our growth well into the 2030s across a broad range of rare diseases.

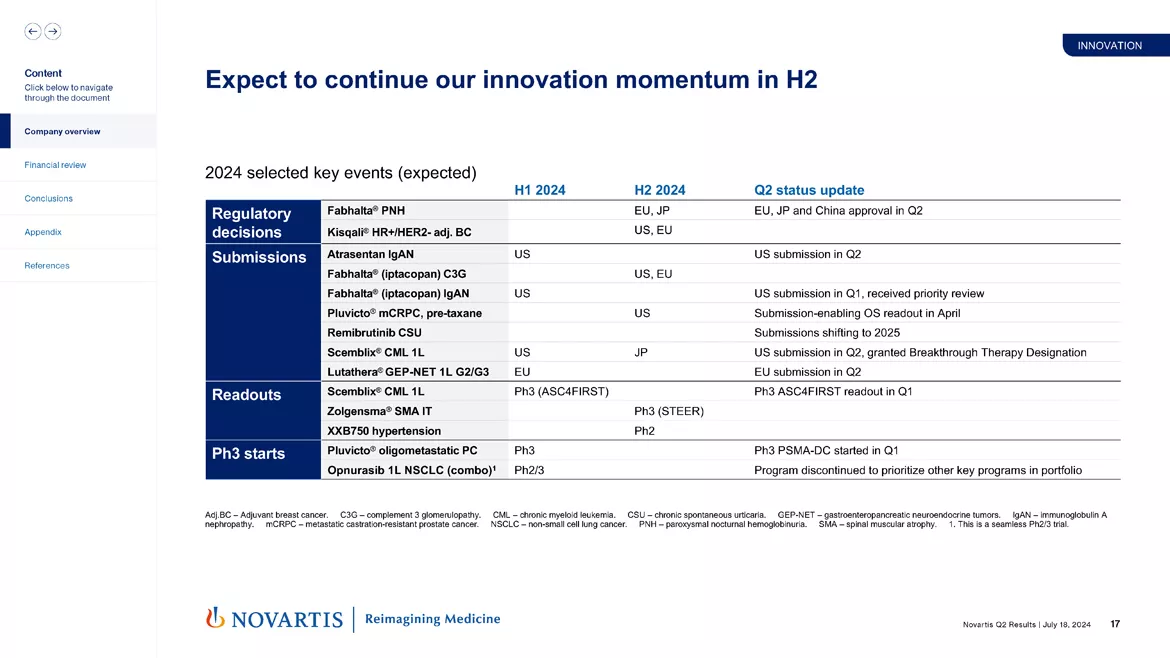

Now moving to the next slide. So in closing, before handing it over to Harry, we expect to continue our innovation momentum in half two. We had 10 positive Phase III readouts in, as you all know, in 2023. Really, this year is about filing and really making sure that we get these medicines ready to launch. But we are excited as well about the next wave of medicines.

One thing we did want to note is we have shifted our remibrutinib CSU filing slightly as we do need to make a few CMC adjustments. But as a reminder, remibrutinib showed biologic-like efficacy in the control of CSU, very good safety profile. So we're excited to get that medicine submitted in 2025 and then out to launch. We do, of course, also expect a steady stream of readouts as well in '25, '26, which we'll profile in upcoming meetings. So with that, let me hand it over to Harry.

Thank you, Vas. Good morning, and good afternoon, everybody. I'll now walk you through, as always, through our financials of the second quarter and the first half. And my comments will always refer to growth rates in constant currencies, unless otherwise stated. I will also be referring to continuing operations that will be still remainder of this year, given the Sandoz spin in October last year. And as you see and have seen already, we had a very strong first half of the year and continued momentum of our quarter one start into Q2.

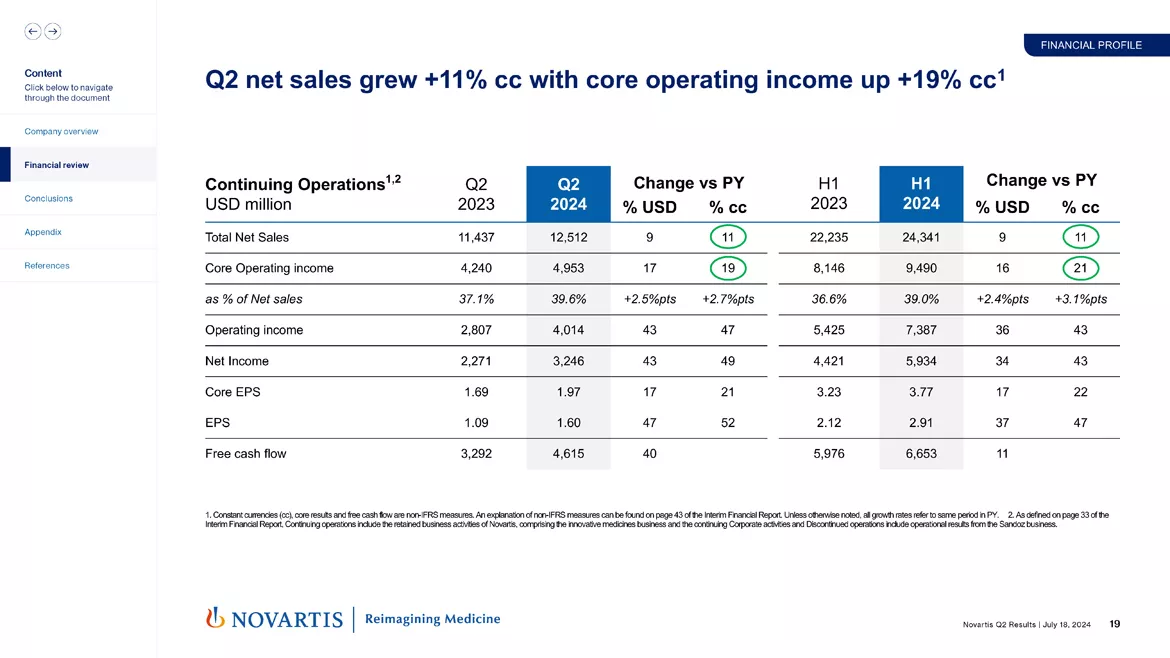

So on slide 19. Now Q2 sales grew 11%. Core operating income was up 19%. Core EPS was USD 1.97, growing 21%. Free cash flow was USD 4.6 billion, very strong, also 40% up in US dollars. For the first half, which you see on the right side, again, the same 11% growth and core operating income up 21% as Q1 was a bit higher than Q2, but both quarters super strong.

And our core margin on the half year, always better look on the longer period, not only one quarter, up to 39% and up 310 basis points, demonstrating clearly our continued progress towards achieving our midterm margin guidance of 40% plus by 2027. Core EPS, USD 3.77, up 22% and free cash flow almost up to USD 7 billion, up 11%.

So clearly, these numbers reflect also the full effect of our pure-play pharma company and our transformation for growth, with a very strong worldwide execution.

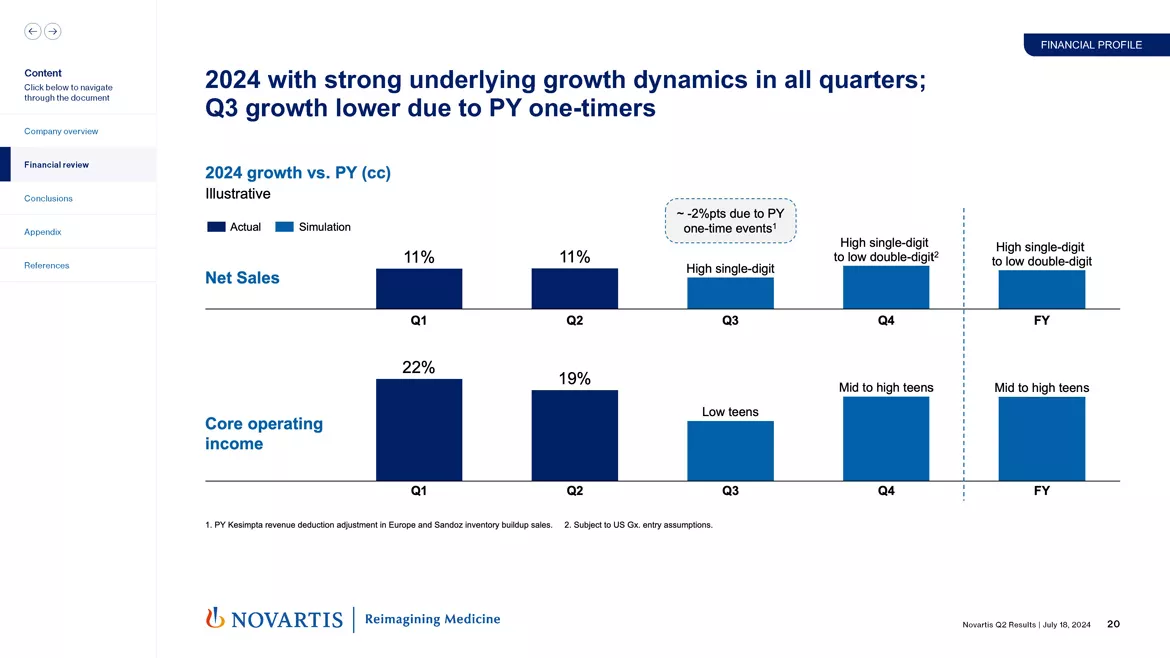

So turning to slide number 20. I think most importantly, to understand that we have our continued strong underlying growth dynamics will really continue. We expect that also for the second half. Usually, we do not provide quarterly guidance, but this time, it may be helpful as you model the remainder of the year.

So with respect to quarterly phasing, I want to remind you that last year, Q3, and those were – we had a couple of one-time effects which are not super significant, but likely we see in quarter three because of these 2 points of one-time effect, more high single-digit growth, so still very strong.

But you may remember we had a onetime revenue reduction true-up of Kesimpta® in Europe. And then we also had some Sandoz inventory built up ahead of the spin. I mentioned this quarter three last year, but some of you may not remember that as you cover so many companies.

And these two items add up to 2 percentage points of sales growth. And so we would anticipate this high single-digit growth in Q3. And then, of course, there is a bit of an effect on core operating income, usually 2 to 3 times of the top-line points. But again, underlying is exactly what we have seen roughly so far.

And then in Q4, it really depends on how the two potential generics come in, Sandostatin® LAR and Tasigna®. And if they don't come in, I would expect us to be at the high end of the guidance, both for that quarter as well as for the year.

So I hope that helps you a bit with the quarterly phasing. And again, usually don't do this, but I think this is warranting also as we increase the guidance for the year on the bottom line. At the same time, we had this quarter three base effect last year.

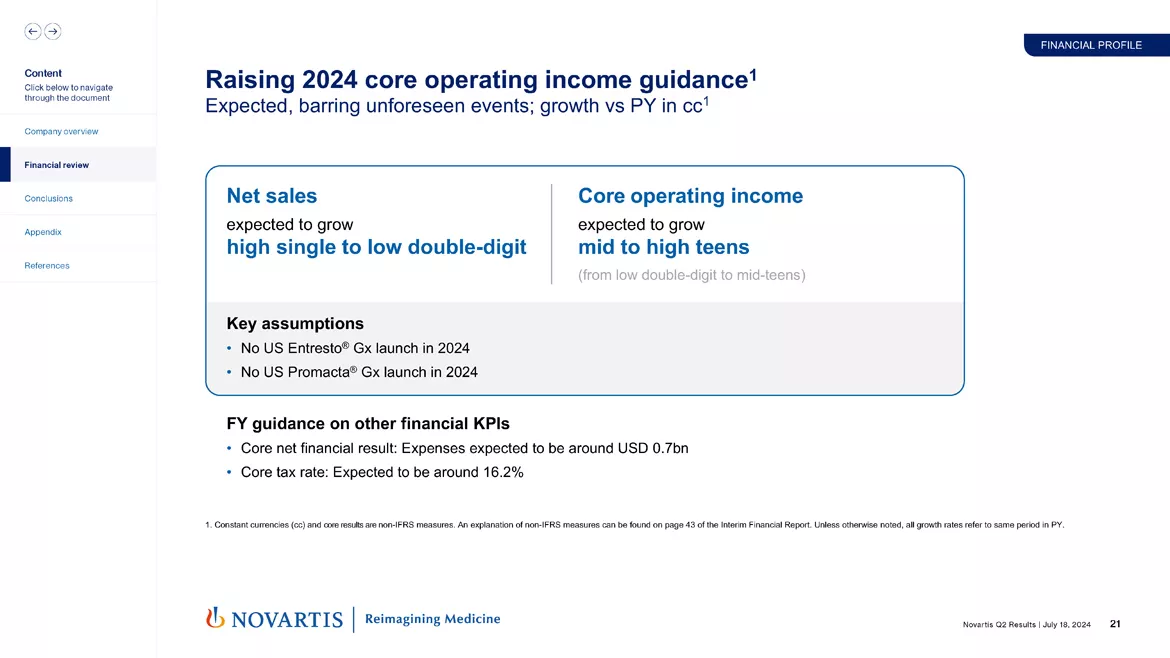

Now moving on to slide 21 for the full-year guidance. We continue to expect sales growth to be in the high single digit to low double digit. However, the strong momentum we are seeing in the business, together with continued productivity results, gives us the confidence to upgrade our bottom-line guidance. We now expect core operating income to grow in the range of mid to high teens from prior double-digit to mid-teens.

Now, as I mentioned before, underpinning our guidance are the assumptions that no Entresto®, no Promacta® generics would launch in the US in 2024. To complete the full-year guidance, please note that we expect the core net financial expenses to be around several hundred million, and our core tax rate to be around 16.2%.

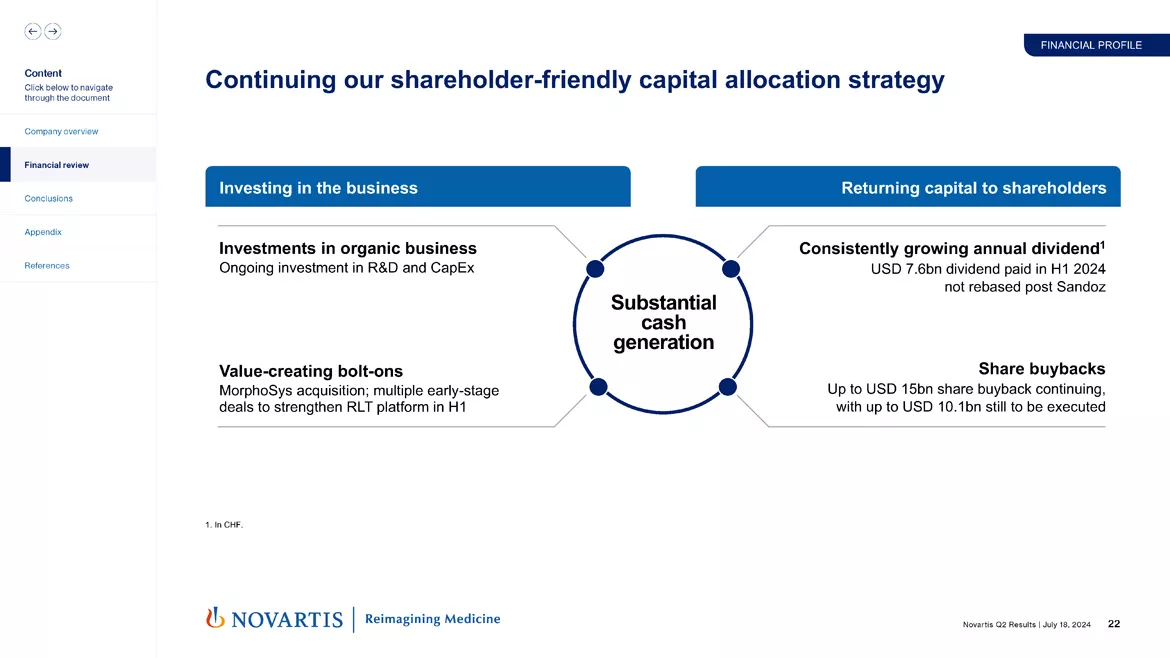

On slide 22, just a little reminder that we remain committed, of course, to our shareholder-friendly capital allocation strategy to invest in the business, while also returning attractive capital to our shareholders. In the first half of the year in addition to investing in our internal R&D engine, we also bought an external innovation via bolt-on M&A and BD&L deals, particularly to strengthen our pipeline in oncology as well as our RLT platform. In terms of returning capital to shareholders, we paid out USD 7.6 billion in dividends in the first half. And we also continue our up to USD 15 billion share buyback, which has approximately USD 10 billion left to be executed by the end of 2025.

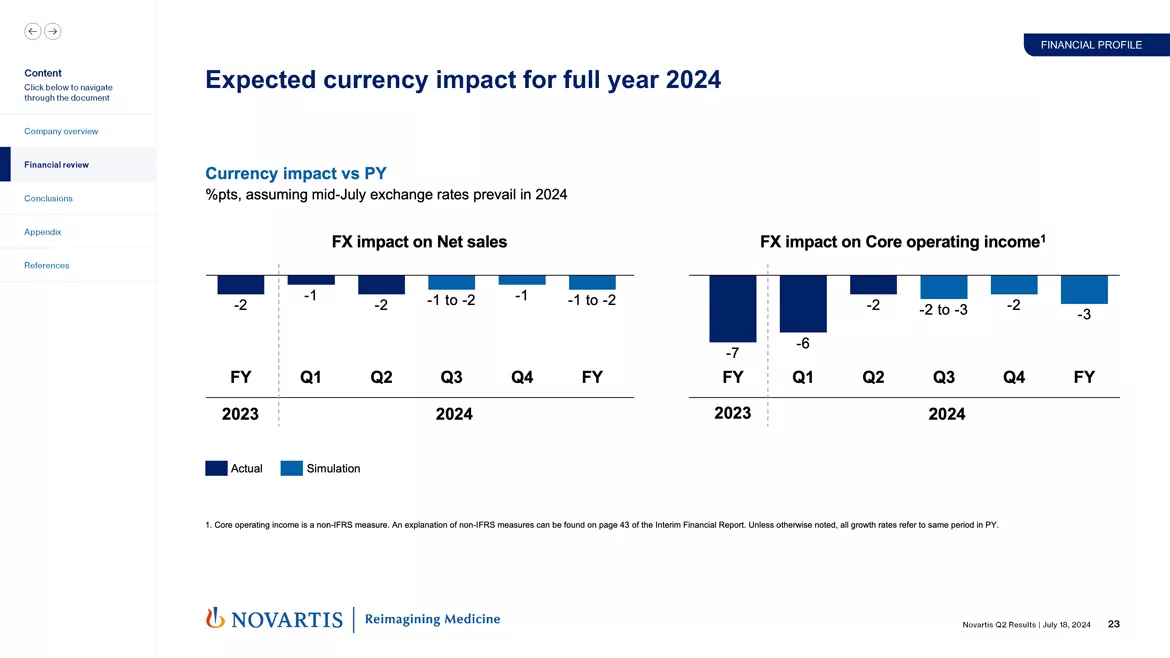

Now on to my final slide around currencies. As always, currencies fluctuate, and we always outline that. And in Q2, FX had a negative 2% point impact on both net sales and core operating income on our results. And if mid-July rates would prevail for the remainder of 2024, we would expect the full-year currency impact to be negative 1 to 2 percentage points on net sales and negative 3 percentage points on core operating income. And as a reminder, the estimated impact of exchange rates in our results are always provided mid-month on our website. Back to Vas.

Great. Thank you, Harry. So before taking your questions, just to briefly summarize.

Continued momentum in quarter two with sales up 11%, core operating margin approaching 40%. We see strong commercial execution, which I think demonstrates our ability to drive our in-market brand medicines, drive our growth brands, drive new launches, system supports our bottom line guidance raise for full year 2024.

Our pipeline continues to advance with the FDA submissions of Scemblix® in the first line, atrasentan in IgAN, our updated data for Kisqali® in early breast cancer. And we're on track to achieve our midterm guidance, 5% constant currency sales growth through 2028 CAGR, 40% core operating margin by 2027. So we think really a great quarter for the company, and we look forward to continuing to drive strong performance through the remainder of this year.

So with that, we can open the line for questions. And as someone mentioned, please, one question per analyst and then we'll come back through the list again. Thank you.

(Operator Instructions) And your first question comes from the line of Emily Field, Barclays.

Q. Thank you so much for taking my question. I just wanted to ask for a bit more context just on the NATALEE delay of the PDUFA in the United States. Can you confirm that this was very specific to the manufacturing issue and that the FDA did not ask for any additional information with regards to any of the subgroups or any additional information from the clinical trials? Thank you.

A. Yes. Thanks, Emily. So this was only related to the CMC issue. We've already initiated label discussions with the FDA. We submitted some additional data to support our provision to the CMC package. With that, we had the standard three-month extension because we have submitted that additional data. So that extends the PDUFA out by three months. We believe now we're well on track having finalized the submission of that data for an approval inside of Q3. Next question, operator?

Your next question comes from the line of Florent Cespedes from Bernstein.

Q. Good afternoon. Thank you very much for taking my question. A quick question on Cosentyx®. The new indication in HS, could you give us some color on how you see the HS opportunity going forward? It seems that you are gaining new patients as you have a new treatment, more potent than the existing one. But there will be also new entrants in the coming years, so some color on this HS market opportunity would be great. Thank you.

A. Yes. Thanks, Florent. As you know, historically, only anti-TNF adalimumab was the only medicine available – biologic medicine available for these patients. And so I think the market had not grown to its full potential. I mean HS is a relatively prevalent dermatological disease.

I think the second most prevalent after psoriasis. So something that – or a second or third most prevalent after psoriasis. So I think it's something that's really a big unmet need. So I would expect there to be a significant expansion in the market as more entrants come in. And we continue to believe that Cosentyx® in HS alone will be a USD 1 billion medicine. So we're very optimistic on Cosentyx®.

Outlook in HS, even with other entrants coming in, simply because there is so much unmet need, most patients are not on biologics or many of these patients have dropped out of the system and are not receiving care at all. Now that physicians know that there are safe options available, we believe more and more patients were brought in. We see that broad-based globally. So as I mentioned as well, we see strong HS uptick for Cosentyx® in the US as well as in EU and international markets. So we think it could be an attractive market in the long run. And we also have a pipeline we're developing as future agents to follow on for Cosentyx® in HS. Now in Phase II studies, but over as it matures, we're excited about can we actually address HS with even higher efficacy medicines over time.

Your next question comes from the line of Emmanuel Papadakis from Deutsche Bank.

Q. Thank you for taking the question. The pipeline question on ianalumab, which you pulled forward the readout in Sjögren's 2025. So just the drivers of that confidence on probability of success. And there's been a number of competitor updates in that space recently, so just perhaps you could refresh us with your thoughts on the magnitude of ESSDAI improvement, you're hoping to show and indeed whether you still consider that to be the right and definitive endpoint. Thank you.

A. Yeah. Thanks, Emmanuel. So absolutely, we saw a very fast enrollment, higher faster-than-expected enrollment for ianalumab in Sjögren's. So we have pulled forward that readout. As you know, Sjögren's, again, relatively prevalent rheumatological disease without really any great – good treatment options. The Phase II data for ianalumab in Sjögren's, so really the first time that you could have a significant improvement in ESSDAI as well as other patient report outcomes.

So obviously, we won't quantitate the magnitude of ESSDAI benefit. But if we can repeat what we saw in Phase IIb, we think that would be really a compelling option. Also, a unique mechanism of action, anti-BAFF, allows you to deplete B cells in multiple compartments, which we think will be important for a disease like Sjögren's which impacts multiple different tissues.

I think what will be important in addition to ESSDAI is patient-reported outcomes. I mean salivary gland function, dry eye, many of these things – these areas are what patients would like to see improve. And if we can demonstrate, in addition to the composite endpoint, PROs that show important benefits for these patients, we think this could be an exciting opportunity.

Overall, we think ianalumab is a multibillion-dollar opportunity in combination with Sjögren's. We have multiple other Phase III programs ongoing in three separate – four separate hematological indications where we expect readouts in 2027. We also take ianalumab to other immunology indications as well. So this is an opportunity for us to really build a significant medicine. And as a reminder as well, this medicine has protection into the mid to late 2030s.

Your next question comes from the line of Richard Parkes, BNP Paribas.

Q. Hi. Thank you for taking my question. I was going to stick on pipeline events in 2025. On pelacarsen, probably your next sort of multi-blockbuster readout. Could you just remind us what your powering assumptions are in terms of the benefit that you're looking to see in the Lp(a) HORIZON trial? And then can you talk about barriers to uptake of Lp(a) targeting agents?

Obviously, PCSK9 uptake has been disappointing for investors partly attributed to the need for injections and costs. I'm just wondering if those barriers are going to also limit Lp(a) targeting agents or is the lack of available alternatives for patients with elevated LP(a) going to mean those barriers are less significant. So if you could just talk about that, that would be great. Thank you.

A. Yeah. Thank you, Richard. So first, in terms of the study design, the way we designed the pelacarsen study was to look at two different levels of Lp(a).

So first, the top quartile, at the top quartile of Lp(a) levels, and then a separate analysis still part of the primary endpoint, which allows us to take a second look at the top decile of patients in terms of their level of Lp(a). And that was based on large-scale epidemiologic studies on how risk evolves from different quartiles and deciles of patients with elevated Lp(a).

So our hope is to show us both of those analysis. I mean our goal will be to show greater than 20% CVRR. But of course, we have aspirations to get even higher. And I think if we can show even higher levels, that would certainly create a lot of motivation in physicians to make sure these patients are tested.

One of the things we've learned, I think, through our various cardiovascular launches is in this day and age to take more of a specialty cardiology mindset in how we think about launching these medicines. So rather than trying to do broad-based Lp(a) testing for patients across large populations, it actually looks very systematically, looking at large-scale datasets and really targeting the group's ethnicities that have the highest risk of elevated Lp(a), and try to promote high levels of testing within those patient populations.

And alongside that to target specialty groups which have a higher propensity to want to test and treat. So those are, of course, cardiovascular specialty groups. But also, when you think about interventional cardiology, I mean there are certain specialty groups we're learning, that have a higher propensity to look for these biomarkers and then treat in order to avoid the recurrence of events, also given the push towards health care quality around the world.

So we're trying to take a very targeted approach in how we think about our Lp(a) launch. In the future as well as cardiovascular launches in general, take a more specialty mindset, which allow us to target to the right patients and the right positions with better resource allocation and hopefully drive more rapid uptake in the future.

Your next question comes from the line of Graham Parry, Bank of America.

Q. Okay. Thanks for taking my question. Just wanted to come back to NATALEE actually. Can you just clarify, you still think there's no manufacturing site inspection needed for the new process? I think you said in Q1, you didn't expect to see – assume you'd actually know by now. And just again, do you remain confident that there is no outcome coming and confidence in the broad label. I know there's some discussion in the market about the node-negative patient population and whether that's approvable or not. Thank you.

A. Yes. Thanks, Graham. Again, based on the label discussions that we have, we're confident in the broad label and there is no manufacturing inspection. I mean all of these changes we've made are all related to product handling. And so I think – and some of the suppliers in the system. So there's no inspections. This is just providing stability data, which we're always obligated to do when we make changes. Once we finish – provide that stability data and have adequate stability data, the FDA takes their decision. So it's really a topic of finalizing that review of our stability data from an FDA standpoint. But we are confident in the broad label, no other inspections, and we're gearing up for launch in late Q3.

Your next question comes from the line of James Quigley, Goldman Sachs.

Q. Great. Thanks for taking my question. I've got one on Pluvicto®. Could you walk us through some of the competitive dynamics you're seeing in the US? I mean you mentioned some of the centers had 30% share. So what is the consideration there in terms of driving the increase in share in those centers?

And then thinking also about the community centers, where are you in terms of the development of the community centers and Pluvicto® and the offering there? And when you speak to docs, physicians in those centers, how are they thinking about Pluvicto®, which is relatively more complicated than the androgen receptor inhibitors, which are overall simple and seems to be launching quite strongly as well? Thank you.

A. Thanks, James. When you look at the dynamics on Pluvicto®, so we have, let's say, roughly 425 centers. In about a third of those centers we – which were really well established, in the VISION population, we see 90% market share. So really high levels of share of the VISION patients. We have another group of centers which are still earlier on in their evolution, we see about 50% share. Our goal is to get them to 90%.

The last third of centers are much more in the community. And here, the dynamics are where we have to just do more work. A lot of it is education. So physicians understand rather than cycling through, in the case of the VISION population, cycling through chemo and perhaps doing extra rounds of chemo better to refer and have the patients receive Pluvicto® given the compelling results that we saw in the VISION study.

So in order to motivate that, we're doing a few things, as I mentioned, another field force to get out there to educate community oncology, community urology, and as well as to strengthen that referral base. Second, DTC to make sure patients understand in the community that there is this option, so rather than cycling through chemo. Earlier on, where we know the earlier patients get Pluvicto®, the better the outcomes to try to motivate that.

And I think if we can unlock that segment over the course of the coming months, we can continue to drive Pluvicto® in the VISION population to the multibillion – or roughly USD 2 billion potential we think there is, and that includes globally. I would say we're seeing very robust uptake in Germany. And over time, we expect robust uptake in other European markets.

Now all of that is important for the current indication, but even more important as we move to PSMAfore, where we have 3 times the patient population. And there, again, it will be really important to, over time, build up confidence in the community to be able – outside of the medical centers, to provide radioligand therapy, not only for Pluvicto® but our whole portfolio of radioligand therapies that we're currently developing.

So we're confident we're going to get there, step by step, but it will take time. I think things like the patient-ready dose will help. I think also enabling – we have a whole team that enables centers to be able to deploy radioligand therapy in their clinics, which will allow them to hopefully not have to refer out, but actually provide RLT even within their centers in their own establishments, which also will be, I think, really, really attractive. So it's all on track in our view, to build this into a major opportunity.

And I would also want to take a moment to reflect that, in RLT, we have a number of things still continuing to develop. We are working on Lutathera® in small cell lung cancer and GB, glioblastoma, both of those are in Phase IIb studies. In addition, we have the clinical stage programs with anti-integrin, anti-bombesin, and anti-SAP.

We're advancing now into a clinic, a program we're very excited about, a HER2 RLT, where we hope to be able to demonstrate that RLT can provide a compelling safety profile versus current HER2 ADCs. And as well, now with the recent acquisition of Mariana Oncology moving rapidly to the clinic, additional RLT programs. Some of which is taking on ADC targets that are established. Some of them taking novel targets, which we think could only be used using RLT.

So that's the level of confidence and investment we have in RLT for the long run, and we look forward now to getting out into the community and over time, establishing this as something that's part of routine cancer care in the US and around the world.

Your next question comes from the line of Mark Purcell, Morgan Stanley.

Q. Yeah. Thank you very much for taking my question. First of all, the revenue aspiration is for mid-single-digit growth out to 2030, and now on a 2024 basis, about USD 66 billion. And when we look at consensus, it's about USD 53 billion at the moment before the results that were very strong today, so about a USD 13 billion gap. So which growth drivers, in your opinion, does consensus underappreciate? And what are the key readouts and progress points that we should look out for, which should close the disconnect between expectations and your aspirations?

A. Yes. Thanks, Mark. So obviously, it's often the case that our aspirations are ahead of consensus. The first thing I'd say is if you look back in 2017, what we said, we delivered (technical difficulty) basis. We were a USD 35 billion innovation – innovative medicines company. And this year, we'll approach a USD 50 billion innovative medicines company. So I think we generally have delivered against what we said we were going to do.

So when you look at the consensus, as you get further out, and as you know, there are fewer and fewer analysts as you get further into the future, there are a few brands that I think are high in our mind. I mean, of course, Kisqali®, Pluvicto®, Leqvio®, iptacopan, all we believe we can drive higher than currently what's out there within the consensus figures. And depending on the brand, there's a different amount of variability.

Certainly, Scemblix® with USD 3 billion-plus potential. But also, with the fact that historically, imatinib achieved USD 4.4 billion globally. We still think there's an opportunity for that medicine's full potential to be appreciated, let's say. And then when you look at remibrutinib, you look at VAY, you also have here medicines that are in late-stage development that will be launching relatively soon, that we think have the potential to also close a significant portion of the gap.

So that alone, those – that portfolio of medicines, all of which have a pretty long time line ahead of them, I think can really help us, hopefully over time, close that gap in the early 2030s. But I think then what is really on us now is to show that the next wave of medicines that we have coming that are going to be compelling.

So of course, medicines like pelacarsen, which we've already discussed on the call. We have novel hypertension and heart failure agent XXB that we'll be reading out relatively shortly in hypertension and soon in heart failure. As I mentioned, a very broad portfolio of RLTs in cancer. And if any one of those were to hit, that could be a very significant medicine. So we're very uniquely positioned there given the scale of size and our ability to do both Actinium and Lutetium.

Taken upon that, we're also not yet in numbers, which is understandable. We continue to have conviction around immune reset. We think between YTB and some of our other programs in immunology, this is a large multibillion-dollar opportunity, which is also difficult for competitors to come into given the scale that we and only a few other competitors have within cell therapy. And then lastly, we have obviously emerging assets within the siRNA space as well, that we're hoping to provide updates on in the coming period.

So a combination of existing assets you all have seen, know and we'll provide more and more data and provide, as you see with our performance today, conviction that they have higher peak sales potential. Second is assets that we hope will read out and get approved in the next few years with significant multibillion dollar potential, and then a very broad early-stage pipeline in our core therapeutic areas, in our core technology areas, which I think, again, will prove out over time.

We look forward to the challenge, but we're very confident that we'll be able to deliver against the goals we set out as we've done over the last seven years.

Your next question comes from the line of Richard Vosser, JPMorgan.

Q. Hi, thanks for taking my question. Maybe a question on pelabresib. Could you probably give us an update on your thinking around the filing? What extra data do you need to file with the product? And what sort of conversations are you having with the regulators around that one? Thanks very much.

A. Yes. Thanks, Richard. So we're still in the midst of completing the acquisition under German takeover laws. So I think there's limited things I can say at this point. But what I can say is we are awaiting 48-week follow-up data, which I think will give us a stronger sense of the overall profile of pelabresib.

We've had good discussions with both the EU and the FDA to get that data. We'll have a better understanding of what will be required in each geography, to ultimately bring the medicine forward for patients with myelofibrosis. So we remain excited about it. But I think we still need to get the data to finalize the exact filing plans that we have in the different geographies.

Alongside that, the EZH1/2 inhibitor, we also acquired in the deal, is something we're rapidly assessing. Given its profile, potential best-in-class profile to take forward in prostate cancer, potentially in other cancers, so that's something we're – as we now go through the process of finalizing the acquisition, also to take that EZH1/2. That would, of course, help us to round out our overall portfolio in prostate. We have Pluvicto®. We have follow-on actinium agents. We recently did a deal with Arvinas for an AR degrader. And then to add on a novel agent like an EZH1/2 could help us, I think, really ensure that we have leadership or amongst the leaders in prostate cancer for the long run.

Your next question comes from the line of Peter Welford, Jefferies. Please go ahead.

Q. Hi, thanks for taking my question. I want to just return to Pluvicto®, if I can, please. Just to understand you talked about some of the barriers in terms of gaining share in some of the sites. But I'm curious, just with regards to the referral pathway and what you're seeing there. Because I guess if you're starting DTC, it would suggest that you've got a high degree of confidence in some of the patients, particularly in the community, can then get to specialist centers for the VISION indication. I guess maybe you can talk a little bit about your confidence about that referral pathway, of being able to get these patients with say then see DTC, perhaps in the wider community into centers able to administer.

And equally then, the phased dose you're talking about with the patient-ready dose. Is that at the moment, do you think, a limitation for the VISION population? Or is that very much geared towards the PSMAfore future use? Just to understand that. And if I can just ask on Germany for Pluvicto®. Just is there a challenge in Europe from still – from the sort of pay hospital, if you like, pharmacy created RLTs? Or are you able to overcome that, do you think, with Pluvicto®?

A. All very good questions, Peter. So first on the referral pathways, we do feel like we're making headway into the referral pathways. But I think as you get further into the community, there is a first tendency among oncologists to cycle through chemo and potentially even cycle back to ARPI before going to a drug like Pluvicto®, simply because of lack of familiarity.

As we move away from special centers where we see very high shares of Pluvicto®, we now need to educate and get more comfort with making that referrals. We think part of that is physician education, hence, new sales force. But part of it as well is patient activation so that patients and caregivers can ask as cycles of chemo are completed, the next step, hopefully, will then be Pluvicto® and then the referrals go out.

But I think alongside of that as well is continuing to also expand the capacity of community oncology centers to provide RLT without having to make a referral is I think an important – really also for the long run for radioligand therapy, it's something important for us to establish. Those things don't happen quickly.

But I think if you go back in history, looking at things like even when chemo was introduced, but other technologies as well, you can eventually get there step by step. So that's very much what we see at the moment. And that's why we're making these additional investments to get to that next phase of growth for Pluvicto® in the US.

Now we're on the patient-ready dose. The patient-ready dose, in my mind, has two opportunities for us. So first, within centers that are at very high utilization rates, there is an interest to actually give even more patients Lutathera® in first-line neuroendocrine tumors for a medium and high-risk first-line neuroendocrine tumors.

And then also to give you even more patients to Pluvicto®, maybe if they are at 50%, 60%, or at 90%, maybe they could even do more. And so by reducing the time, the chair time, the prep time for a given patient, you expand the capacity of those centers. So it's something we've been working on for some time.

And then that will become even more important as we get to PSMAfore and we triple the number of patients within those centers. We want to be able to have that capacity for them to be able to treat more and more patients. And of course, chair time is what eventually could become a constraint. So we want to get ahead of that with the patient-ready dose.

Now lastly, with respect to Germany, we've achieved attractive pricing in Germany. We see very strong uptake in the initial days. And we're seeing shares – to the extent we can get the data, we're slowly but surely 80%, 90% share versus the so-called home brews or pharmacy developed RLTs. So we feel confident now with reimbursement in place that will now become the real only option for patients in the – desiring PSMA RLT therapy in Germany. So we're excited about the German opportunity.

I would say as well, China, I've recently visited RLT centers in Shanghai. There is a lot of interest in China. And you've seen us be very successful in launches, whether it's Cosentyx®, Entresto®, Leqvio® in China. And so the opportunity there is significant – on track to file in China in the second half of this year. We've done a groundbreaking for a new manufacturing site in China.

And then lastly, in Japan as well, a lot of interest in RLTs. So I think the Asian markets as well will give us a boost for our RLT and Pluvicto® in the medium term.

Your next question comes from the line of Peter Verdult, Citi.

Q. It's Peter Verdult from Citi. Can we go big picture, please, on IRA. Just what is the latest you're hearing from your contacts about how the initial price negotiation process is going for the industry? How manageable you feel IRA is for Novartis going forward? And with pelacarsen in mind, whether there have been any developments that give you increased confidence you can get oligonucleotides to be given the same 13-year exclusivity period as biologics?

A. Yes. Thanks, Peter. So first, we'd say it's not a negotiation, it's government price setting. It's not a situation where a company has the opportunity to, in effect, walk away from the prices that are set by government.

I'd also say, while in the short term, this might be manageable on our first set of drugs. In the long run, this policy is really not good for innovation, good for patients in the United States. And the companies are managing, managing by shifting away from small molecule medicines for (technical difficulty) therapies. And neurological diseases, maybe they can only be treated by small molecules.

So I think it's very important to say the policy is not a good one. It's bad for American patients, it's bad for innovation and sincerely hope that it gets corrected. Now in terms of our midterm guidance, we factored in and our single digit – or mid-single-digit guidance into the 2030s, we factored in IRA.

And so we manage it through a combination of the kinds of medicines we develop, the indication we go after, et cetera, and that's how we're approaching it. Can't comment on the current price setting approach that CMS is taking right now. Those prices will obviously come out in – for Entresto® in September. I think right now, our focus is very much still to shift the policy.

There are a few bills in play. There is a bill that is currently being discussed to, as you rightfully mentioned, correct genetically targeted therapies, a bipartisan support, has passed through multiple committees. So we continue to be hopeful that ASOs, sRNAs and related technologies will move from 9 to 13. Another bill that is being discussed is within the rare disease framework, to move off of a single rare disease to multiple rare disease drugs to have the same benefits if you're in a single rare disease.

So if you take a case study like Scemblix®, our ability to develop Scemblix® beyond CML in another rare cancer is limited because of the IRA’s policy. And maybe it would make sense to actually develop it in another cancer type, but difficult to do given the IRA policy.

So I think that's a second bill out there. And then third, there's the full correction of 9 to 13. So I think when I'm on the Hill, I have good conversations. I think there's a broad recognition that there needs to be something done because this was an unintended consequence of a poorly drafted legislation. But how that actually transpires given that we're in a political cycle, I think we'll have to see in 2025 and beyond.

Your next question comes from the line of Kerry Holford, Berenberg.

Q. Hi. Yes, Kerry Holford, Berenberg. Just one quick question for me on remibrutinib. The delay of the filing in CSU into next year, you referenced a few CMC adjustments. So I wonder if you could provide a little more detail on that, what's required and how long the delay is obviously?

A. Yes, absolutely, Kerry. So in the process of finalizing our manufacturing process, we've determined that a single step in the process called nano-milling, for those who are interested, needs some adjustments in terms of time and temperature to make sure that the product profile is optimal. So we're making those adjustments.

And once we make those adjustments, as was the case with Kisqali®, when we made those adjustments, we have to generate stability data. And so the time to generate the stability data then drives the time line for the filing. We're certainly hopeful that we can get that stability package put together ASAP and then get the file in, because we were ready to go in the filing.

And unfortunately, found this at a relatively late stage. So our hope is to file in the earlier part of next year and then get an approval relatively quickly thereafter. We certainly have many PRVs in hand. We have not determined yet which ones we'll use, we certainly have the capacity to use PRVs. So we hope to be able to close the gap then and make remibrutinib available for patients in the US and then eventually around the world.

Your next question comes from the line of Seamus Fernandez, Guggenheim Securities.

Q. Thanks so much for the question. So Vas, the question is really for you strategically, as you look at the growth opportunities in the industry and across the industry, oncology, immunology and now cardiovascular metabolic disease with obesity, are all core therapeutic areas. One area that Novartis is not currently present in is obesity. You've been in a position to think strategically and act strategically in immuno-oncology, perhaps with disappointment. Just interested to get your thoughts on the opportunity for a late entry into the obesity market, and how Novartis could potentially or would potentially make sense of that strategically, whether with existing assets or only as a completely novel approach or novel mechanism moving forward? Thanks so much.

A. Yes. Thanks, Seamus, for the question, as you can imagine, it's something we put a lot of thought into and have looked at many of the opportunities that are out there. To address obesity, which clearly had the opportunity to have a significant health impact, not only on obesity, but many related conditions that are continuing to see in the data.

Our view is with the current GLP, GIP, GIPR oral and injectable class of medicines, they're going to be very well served by the two leading incumbents who are doing extremely well in the market and are rapidly developing follow-on agents. And so to come in with fast follower on those two medicines even with modestly differentiated profiles will be difficult.

Because when those medicines come forward at the end of the decade, you will have substantial rebate walls. You will have a substantial portfolio block in place. And so very difficult to enter with just another of – something that's relatively similar to what's already out there. You can imagine massive amounts of free drug floating around simply because of the size of the rebates that actually be out there towards the end of the decade. So we choose not to participate in that.

Insofar, as we might need one of those assets as a combination asset for our own portfolio, but rather our core focus is thinking about next-generation medicines to address obesity or related conditions in cardiovascular health. That includes much more long-acting agents, either through biologics or siRNAs, that includes new mechanisms of action, all preclinical, but the ones that we're exploring, either that can provide dosing advantage, tolerability advantages or the ability for muscle sparing.

There could be centrally acting mechanisms that are not necessarily targeting directly the pancreas and orthogonally the central pathways, but actually directly the central pathways. So those are all things we're working on. But we stick by our conviction to stay disciplined. We had the experience of coming late into PD-1 inhibitors, immuno-oncology, with lots of capital spent.

In the end, probably not well spent. Rather say, where can we bring something really unique forward, gives us a unique position not only from a physician-patient standpoint, but in the US, what will matter immensely – and we know this watching many cardiovascular medicines – is you need a compelling proposition for payers.

And coming in late with another one of the orals or injectable GLPs, GIPs, we think is not a prudent approach for us as a company. Rather look for next breakthroughs – or breakthroughs in other areas and other areas of medicine, where – that are underserved. There's enough other areas of medicine that are underserved, and we think there's plenty of opportunity for us to drive dynamic growth in those areas.

Your next question comes from the line of Rajesh Kumar, HSBC.

Q. Good afternoon. Just on capital allocation. You have maintained a very capital disciplined approach in terms of what sort of valuations you're paying for M&A as well as what sort of returns you're looking at. When you are in competitive situations, can you give us some color if your competitors are behaving in a similar way? And if they are not, what are the tools you have to work around that?

A. Yes. Thanks, Rajesh. So I think, obviously, I don't want to comment on specific competitors, but I'd say there's variability in terms of capital discipline. And I think now seven years in the role, I've learned the value in playing the long game, staying disciplined, not overstretching. In the end, information asymmetry is a huge disadvantage whenever you do external deals. So you have to be prudent. You've seen us shift to, again, mostly deals, sub-billion. And if anything, a handful of larger bolt-on deals. We try to stay disciplined against our financial measures. And if we are outbid and it's not within our envelope, we just walk away.

And we're okay with that. There will be other opportunities that come. And then rather use our capital to buy back our own shares, as we're doing it in a disciplined way. We are confident in our growth profile. As Harry mentioned, we have still USD 10 billion in our ongoing buyback program.

With buybacks are part of the capital allocation principles of Novartis, return capital to shareholders through dividends and buyback. And then prudent M&A where we see the opportunity to build one of our TAs or one of our technology platforms.

The reality is more and more that happens earlier, so more and more deals that are earlier on the smaller side, because there is an opportunity for where you have a differentiated view versus your competitors. You may have a different view on the science or different expertise, which allows you then to take prudent bets.

We, of course, always look at all opportunities. And if there's something we think we can really generate significant value and we generate the returns that we would expect from a deal, we'll, of course, go after it. But on bidding wars, we're not – I think the company that wins like big bidding wars where companies are going to pay well beyond at least what we would say the valuation of the target asset is. Thanks for the question.

Your next question comes from the line of Jo Walton, UBS.

Q. My question comes back to Pluvicto®, if I could. And just to look at the number of cycles that a patient is actually taking. I know the maximum is six. If you could tell us what you think the level is today. I think it is quite a bit below six. And how we should be thinking about that going forward into new indications? Do you think you are going to be able to expand the number of cycles? Many thanks.

A. Yes. I think – Jo, thanks for the question. So right now, we're at three to four cycles per patient, which is really because – especially in more of the community setting, we're seeing referrals that are too late, and we would really like to push the referral rate earlier. I think an earlier indication – and so in effect, sadly, the patient might demise or ultimately progress because of the very late nature of the disease.

So I think rather when we get to the earlier line, this will be less of an issue. People will complete their six cycles. We have the situation where patients have been kept on chemo probably too long, they can only tolerate three cycles before ultimately succumbing to their cancer.

And so that's something – another benefit, I think, as we move into the PSMAfore population, in the hormone-sensitive population, in these healthier populations, we would expect the full six cycles, which should also give us a lift.

So when you think from a patient volume standpoint on Pluvicto® in VISION, we're actually doing pretty well. It's just I think we just need to get those referrals earlier and get the referrals deeper in the community, and that will get us, I think, back on track to that USD 2 billion goal globally on the VISION population and then well on track as well for the much bigger aspirations we have for the full range of indications.

Your next question comes from the line of Tim Anderson, Wolfe Research.

Q. Hi. If I could come back to IRA. There's no formal gag order preventing drug companies from talking about price negotiations that are ongoing. But CMS still seems to be out there telling all the companies that basically to keep quiet about it, and all the companies are obliging. And I'm trying to figure out why.

One could read into this that CMS doesn't want companies saying, it's no big deal. We can manage it, because that would take away from a later announcement by them about the big price concessions that they've been able to achieve. So can you kind of share your thoughts on that one aspect of IRA. Thank you.

A. Yes. I don't know – I don't have much insights on that, Tim, unfortunately. But what I can say is that these are ongoing discussions, the price setting – we continue not to call it a negotiation, the price-setting process is one that have had multiple rounds. And I think often in these situations, there's no benefit for us to particularly go public as we continue to try to finalize the discussions and take it from there.

I think the reality is in this initial round from my two cents, I don't – I can't speak for CMS. But in this initial round, you have a set of medicines that are close to – relatively close to LOE, and because of that, companies that are in generic entries within a certain period of time, and so probably many companies would say this is all manageable because it's relatively short term.

When you start getting hundreds of drugs on this list and you have drugs that are earlier in their life cycle in areas where you need more time to actually generate the peak sales and the return, I mean, this compound and it gets uglier and uglier.

So I think it's just important for all of us to keep pushing the government to fix the legislation. 13 years, 15 years is manageable. Nine years for a small molecule, depending on the indication or the ability to go into multiple indications or multiple cancer types, is a challenge.

And the way the industry will manage it is we'll just shift away for small molecule drugs for the elderly, which means patients with oncology conditions and neuroscience conditions and certain cardiovascular conditions will suffer. And I think that's the message that policymakers need to hear.

Last question, I think, is from Graham. Graham?

Your line is now open, Graham.

Q. Thank you. Great. Just a follow-up on Kesimpta®, obviously had a very strong quarter there. I just wondered if you think you might need to really visit your peak guide there. And if so, when. And if you can just help us understand how far penetrated do you think you are into peak opportunity in the US and then rest of world, which now seems to be driving almost as much of the growth as the US?

A. Good question, Graham. I think area of internal debate as to how big could Kesimpta® be. Certainly, just to give you some numbers in the US, we have [20% TRx] B-cell share of all patients in RRMS. So there's plenty of room to run most of that at the expense of older medicines, the so-called BRACE, as you know well. So plenty of room to create a larger – basically, the market size for B-cell inhibition and MS could double in the United States as physicians get more and more comfortable with B-cell inhibitors.

Similarly, we see similar dynamics in Europe. Obviously, in Asia, MS is less of a topic. So again, an opportunity for further expansion. So we're certainly looking at the peak sales potential for Kesimpta®, I think when we're in a place where we can provide more precise guidance, we certainly will. I think one area, of course, we have to watch is the BTK inhibitors.

But as you know, the data has not been great so far. Remibrutinib is continuing on track in MS. But if anything, we now view the BTK inhibitors as perhaps supportive, but not being able to replace the B-cell monoclonal antibodies, which also gives a tailwind to Kesimpta®'s long-term potential as well.

So I think that's everything for today. So thank you all very, very much for the call. We look forward to providing you another update in Q3 and then also looking forward to seeing you all at Meet The Management in November. So thank you again.

Disclaimer: The information in the presentations on these pages was factually accurate on the date of publication. These presentations remain on the Novartis website for historical purposes only. Novartis assumes no responsibility to update the information to reflect subsequent developments. Readers should not rely upon the information in these pages as current or accurate after their publication dates.